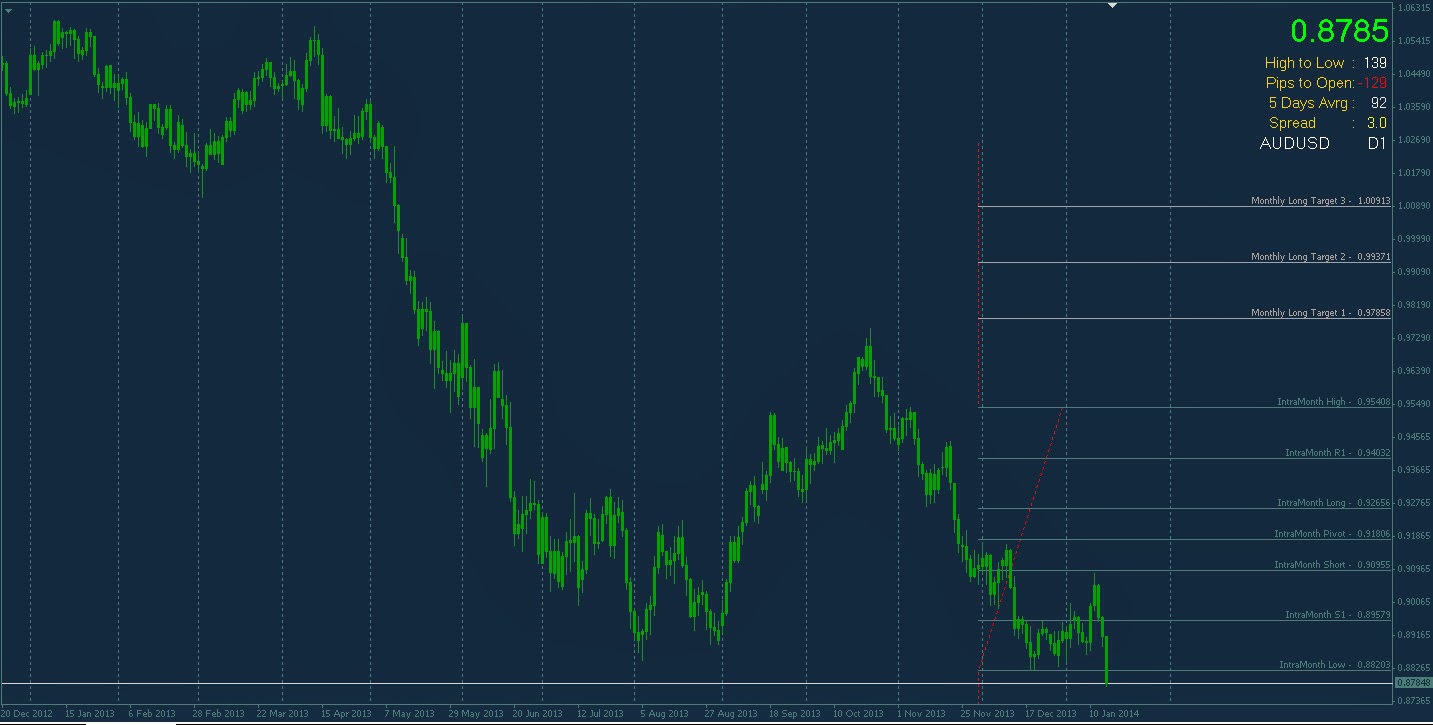

AUD/USD Trade Review

Published on Kamis, 16 Januari 2014

19.17 //

my trading journal

I wrote it in My Journal forThis Pair ( Just My Foot Prints right there :D ), it was about couple years ago, The analysis for this pair,.AUD/USD is very clear and for sure, EUR/AUD, GBP/AUD etc they have a very strong correlation and have to move to the other direction. No Matter what's The News keep coming Up right now, There is a Pair Movement's rule.

Aussie dollar slumps to 3-1/2-year low after jobs data

The Australian dollar tumbled to its lowest level since mid-2010 against a firmer U.S. dollar on Thursday, after a surprise fall in employment reawakened the possibility of another cut in interest rates.

The Aussie fell as low as $0.8777 in early trading, with trading volumes high, and was last 1.5 percent lower at $0.8803 . Its next target to the downside will be the $0.8770 hit in August 2010, said one trader.

The Aussie was also 1.1 percent down against the New Zealand dollar at $1.0571, its lowest since the end of 2005, with talk among traders of selling by large hedge funds.

Australian employers shed jobs at the fastest pace in nine months in December, with full-time positions hit hard in particular, contrary to economists' expectations of modest job gains.

Investors reacted by reviving the prospect of another cut in interest rates from the Reserve Bank of Australia, which has been signalling it would rather not ease again from the current record low of 2.5 percent.

The Aussie has been a big target for manager-driven hedge funds, notably CQS founder Michael Hintze, who have focused on central bank governor Glenn Stevens' wish for the currency to weaken, as well as signs of weakening demand for its natural resources.

Computer-driven hedge funds, meanwhile, have also latched onto the currency's slide.

"You've had the unemployment data overnight, while the strength of the (U.S.) dollar suggests money is moving towards the dollar and away from the commodity currencies," said Richard Perry, analyst at Hantec Markets.

He said that while technical factors suggest there could be a small bounce in the Aussie, it could encounter resistance between $0.8820 and $0.8863.

"I'd be using that technical rally as a chance to sell. It does not look good," he said.

Volumes were much higher in euro/dollar, with the single currency gaining 0.04 percent at $1.3608 ahead of euro zone inflation data later on Thursday.

The U.S. dollar itself was up after data this week held out hope that Friday's non-farm payroll data - which shocked markets with a reading well below forecasts - was an anomaly and did not signal the economy had lost steam at the end of last year.

Data on Wednesday showed producer prices recorded their largest gain in six months in December, yet there were few signs of any sustained price pressures. The figures came a day after U.S. retail sales rose and a core spending gauge posted a big jump.

Investors were encouraged to go long on the greenback, again betting the Federal Reserve can continue to unwind its massive bond-buying stimulus over 2014, a move that would likely push bond yields higher and attract investors back.

The dollar was 0.2 percent higher against the yen at 104.76 yen, within striking distance of a five-year peak of 105.45 yen scaled at the start of the year.

But some traders said there were sizable offers above that level, possibly capping the dollar's gains in the near term. Traders also said U.S. consumer inflation data due later on Thursday would be closely watched.

"A strong inflation print may encourage the Federal Open Market Committee to take a more aggressive approach in normalising monetary policy as the central bank sees a more robust recovery in 2014," said David Song, analyst at DailyFX.

"With that said, a positive CPI print may spark a bullish reaction in the USD, but the dollar may face a larger decline over the near-term should the data print fall short of market expectations."

The dollar index was up 0.1 percent at 81.078 back to the highs seen last Friday. The dollar continued its strength against the Canadian dollar, rising 0.1 percent to C$1.0946 , near a four-year high of C$1.0992 hit on Wednesday.

Also helping the U.S. dollar, one of the Federal Reserve's most outspoken doves, Chicago Fed President Charles Evans, said he backed a continued wind-down of the Fed's bond-buying programme and could even see bigger cuts to the programme if the economy strengthens.

Professional traders already have the knowledge and experience to know which trading techniques and trading systems could be profitable and which trading techniques and trading systems should be avoided, but professional traders are not looking for a new trading technique or trading system (because they are already trading correctly). New traders do not have the knowledge and experience to know which trading techniques and trading systems could be profitable and which trading techniques and trading systems should be avoided, and new traders are exactly the traders who are looking for a new trading technique or trading system (and even worse new traders are often still looking for the holy grail of trading).

Professional traders already have the knowledge and experience to know which trading techniques and trading systems could be profitable and which trading techniques and trading systems should be avoided, but professional traders are not looking for a new trading technique or trading system (because they are already trading correctly). New traders do not have the knowledge and experience to know which trading techniques and trading systems could be profitable and which trading techniques and trading systems should be avoided, and new traders are exactly the traders who are looking for a new trading technique or trading system (and even worse new traders are often still looking for the holy grail of trading).

Quantum Binary Signals

BalasHapusGet professional trading signals delivered to your mobile phone daily.

Start following our trades today & make up to 270% per day.